The Five well-known Threats: How They Risk Your Financial Future

- premsinha1211

- Jul 17, 2023

- 2 min read

Amidst the whirlwind of the fast-paced modern world, our financial futures are persistently at risk. Various factors contribute to this uncertainty, such as inflation, sub-optimal investment products, financial market unpredictability, Ponzi schemes, and mounting loans.

Yet, there's one key solution that stands as a shield against these threats - Investment education.

1. Inflation- the Silent Killer :

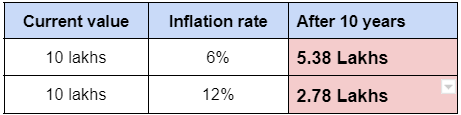

A comprehensive understanding of inflation is vital to future financial stability. Termed as a silent killer, inflation persistently erodes the purchasing power of your money. With government data suggests inflation rates fluctuate between 6-8%, and even escalate to 12% when accounting for lifestyle inflation.

For instance,

An amount of Rs. 10 lakhs will only be worth around Rs. 5.38 lakhs or even as low as Rs. 2.78 lakhs after a decade due to inflation.

2. Think beyond low efficient Traditional Investment Products:

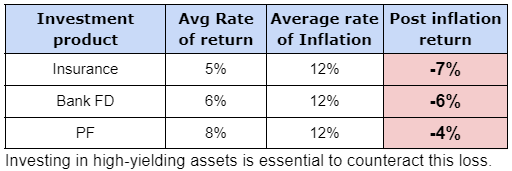

People often resort to traditional investment products like Insurance, Fixed Deposits, and Public Provident Fund (PPF), unaware that they are potentially losing out. These methods, although reliable, hardly offer returns exceeding the inflation rate, making it a challenge to accumulate wealth.

3. The unpredictable outcome of Financial Markets:

Investing in financial markets through mutual funds or direct investment may promise higher returns, but it also comes with its share of risks and unpredictability. Market volatility often leads to portfolio losses and inconsistent returns, causing investors to hesitate in investing substantial capital.

With little knowledge or investing in others’ advice can be a big threat to your financial future.

4. Fraudulent or Ponzi Schemes:

Ponzi schemes, promising high returns with little or no risk, often lure unsuspecting investors, leading to significant capital loss.

Investment education arms you with the knowledge to differentiate between legitimate investment opportunities and fraudulent schemes.

5. Compound interest- A Boon or Curse:

As Einstein famously said, "Compound interest is the eighth wonder of the world.

He who understands it earns it … he who doesn't … pays it.”

Loans for necessary goals like home or education are justifiable, but in the current scenario of easy credit access, people often succumb to the allure of loans for cars, holidays, or even mobile phones.

Falling into such EMI cycles can turn the marvel of compound interest against you.

To secure your financial future, it is crucial not to rely on others for managing your hard-earned money. We spend about 20 to 22 years and a huge amount of money to learn "How to Earn Money."

Why not to invest a few months and a comparatively tiny amount to learn about managing your investments?

In conclusion, arming yourself with investment education is the key to navigating the uncertain terrain of personal financial management. It provides the tools necessary to tackle inflation, make wise investment choices, navigate financial markets, avoid scams, and control debts. Your financial future is in your hands, so empower yourself with the knowledge to secure it.

Comments